Carbon Border Adjustment Mechanism (CBAM) with SOLUTION4

Overview: What is CBAM?

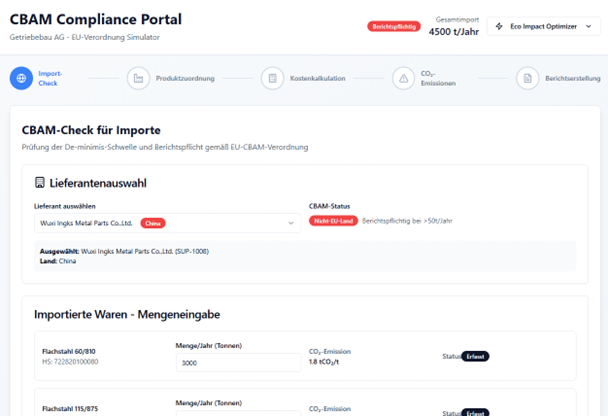

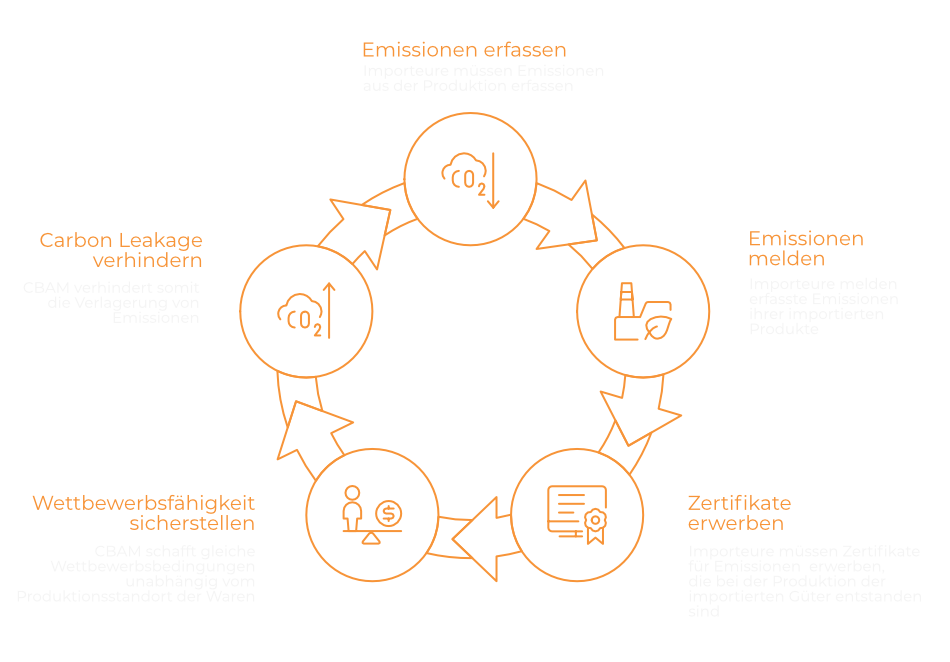

CBAM is the EU’s Carbon Border Adjustment Mechanism: Starting in 2026, importers of certain energy-intensive goods (e.g., cement, iron, steel, aluminum, fertilizers, and electricity) will be required to comprehensively record and report the greenhouse gas emissions generated during production outside the EU. For each imported tonne of CO₂, corresponding certificates must be purchased—creating a “level playing field” between European and international markets and preventing carbon leakage.

CHALLENGES with CBAM

Automated. Integrated. Audit-Proof.

Your BENEFITS highlighted

Compliance-Security

Meet all CBAM legal requirements effortlessly.

Efficiency and Transparency

Centralized, automated data collection in a powerful CBAM software solution reduces errors and effort.

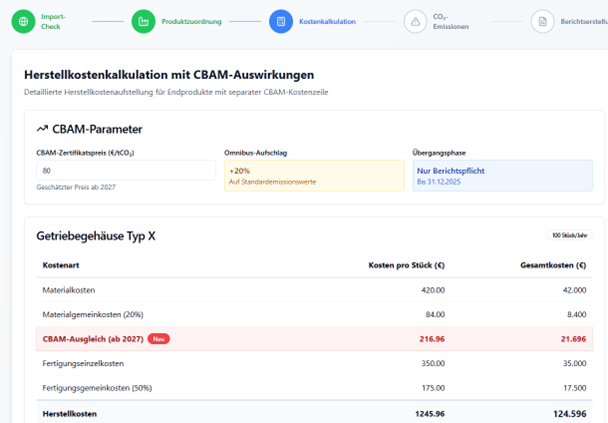

Cost- and Effect Simulation

Analyze the direct impact of CO₂-costs on product pricing and profitability across contribution margins, customers, and profit centers.

Competitive Advantage

Dependable CBAM reporting for seamless imports and strong trade relationships, with a scalable solution adaptable to new product groups as needed.

-

Automatically identify and flag CBAM-relevant products and imports through bills of materials and HS codes

-

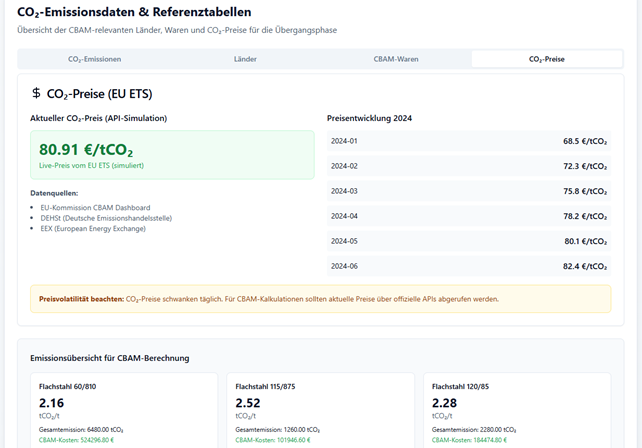

Determine and validate of CO₂ emissions, with automated CO₂ calculation where supplier data is missing

-

Simulate emissions costs and assess their effects on pricing and key performance indicators

-

Automatically create and submit quarterly CBAM reports to the relevant authorities

-

Maintain full documentation, record management, and audit trails for regulatory and customs compliance

Want to know more?

Contact us today! We’ll help you identify the best solution tailored to your company’s needs.